True dtac Collaborates with NBTC to Strengthen Measures Against Scams

-

True DTAC ready to support government measures to enhance security of mobile banking usage, confirming that it will facilitate customers to continue using mobile banking in accordance with government policy.

True and DTAC customers can check their status whether required to update the registration

- Inbox of your Mobile Banking Application: Check the message notification via inbox or alert menu. If no notification is received, no further action is required.

- If you have received a notification from the bank but have not taken any action, you can continue to use your True/dtac mobile services as usual. However, your Mobile Banking service will be suspended, you will still be able to use your bank account, withdraw funds at the bank, and use your ATM card as normal.

The date of Mobile Banking suspension will be determined by each bank, starting from June 1, 2025.

If your Mobile Banking service has been suspended, you can contact your bank to request reactivation by following these steps:

- If your registered phone number is still active, you have two options:

- Contact the bank to request an exemption:

Provide documents showing your relationship with the SIM card owner and a recent mobile service payment receipt.- Family members: House registration (for parents, siblings, grandparents), birth certificate (for children), or marriage certificate (for spouse)

- Organizations: A company letter confirming employee name and phone number

- Legal guardians or persons with disabilities: Court appointment documents or disability card/official document

- Contact True Shop/dtac Shop:

You can either:

- Register a new SIM (at True/dtac Shop), or

- Change SIM ownership to match the Mobile Banking registration name

- Then, present a service entitlement certificate or a payment receipt issued within the last month to the bank for reactivation.

- Contact the bank to request an exemption:

SIM Ownership Transfer Process/Change the Owner:

- Postpaid customers: Visit any True/dtac shop

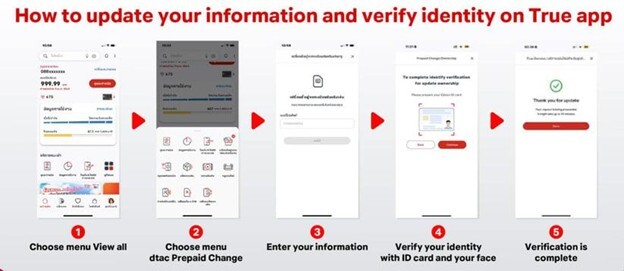

- Prepaid customers: Self-service via the True Application (Prepare your ID card ready and insert the SIM to receive OTP)

- Main Menu Select: “Prepaid Change Owner”

- Or Click Link as below

- True :

Thai https://s.true.th/3aCz/i6exnm8k

Foreigner Visit True Shop, True Partner - dtac (Thai and foreigners):

https://s.true.th/3aCz/1xdoy55r

- True :

How to update your registration information via the True app:

- Download the True App from the Play Store or App Store (version 10.5.1 or higher).

- Log in using the mobile number you intend to use, and enter the OTP sent to that number.

- Go to the main menu Select “Prepaid Change Owner”

2. Prepare the certification documentation to verify directly to bank to remove mobile banking service suspension: Receipt or Service Certification Letter

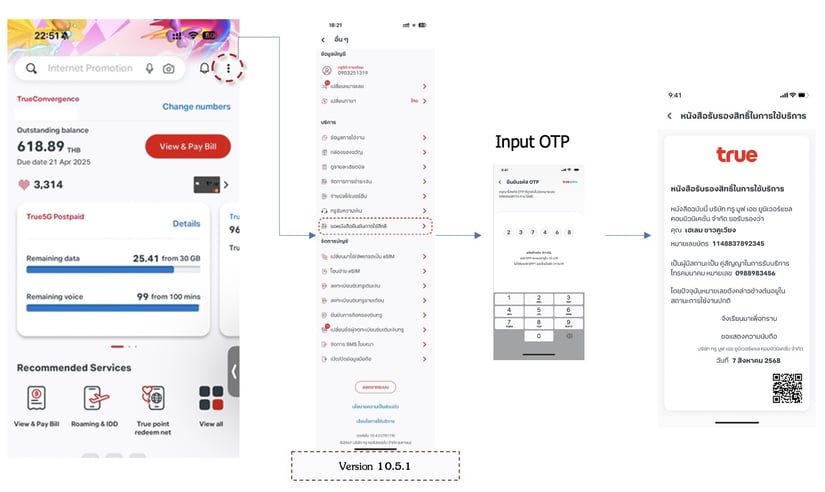

How to Request a “Service Certification Letter” via True App (Self-service)

- Available for both prepaid and postpaid customers

- Request via True App → Main Menu 🡪 Select: “Service Certification Letter”

- Or Click https://s.true.th/3aCz/xaopaf2r

- Download the True App from the Play Store or App Store (version 10.5.1 or higher).

- Log in using the mobile number you intend to use, and enter the OTP sent to that number.

- Go to the main menu (tap the three-bar icon on the right-hand side of the screen).

- Select “Service Certification Letter” from the menu.

- The certificate will be displayed in Thai or English, depending on your user profile settings.

Note:

- The certificate will be generated only for the mobile number currently logged in on the True App. To request a certificate for a different number, you must either switch numbers within the app or log in using the desired number.

- If the information shown in the certificate does not match the actual user, the certificate cannot be used as official documentation for banking purposes.

Service Certification Letter

3. Check if the mobile number you are using matches the registration information linked to your mobile banking service.

- For True & dtac Postpaid customers:Dial *179*ID card number# and press call

- For True Prepaid customers:Dial *153# and press call

- For DTAC Prepaid customers:Dial *102# and press call

Frequently Asked Questions (FAQ)

Q1: Is it true that mobile banking usernames must match the name registered with the mobile SIM card, or transactions will not be possible? Why?

A1: Yes, this is true. This measure is part of a security initiative by the Ministry of Digital Economy and Society, the Anti-Money Laundering Office (AMLO), the National Broadcasting and Telecommunications Commission (NBTC), the Bank of Thailand, and the Telecommunications Association of Thailand. It aims to enhance mobile banking security and prevent “mule accounts” used for fraud. The rule requires the name registered with the SIM card to match the bank account holder’s name for mobile banking services. This requirement will take effect on May 1, 2025. Until then, you can continue using the service as usual. Please check with your bank for further details and necessary actions.

Q2: According to the latest announcement (January 31st, 2025), banks will notify customers between February - April 2025 if their mobile banking name does not match their SIM registration owner name. What should I do if I receive (or do not receive) such a notification?

A2:

• If a customer receives a notification from the bank – Follow the instructions provided in the message from the bank.

• If a customer does not receive a notification – No action is required. The customer can continue using mobile banking as usual.

Q3: Why must the SIM registration name match the mobile banking account name?

A3: This is a government-mandated security measure to set standards and prevent fraud.

Q4: What will happen if the name is not corrected within the specified period?

A4: Customers will still be able to use their mobile phone services as usual.However, after May 1st, 2025, they will no longer be able to conduct mobile banking transactions until they update their information with the bank. The deadline for corrections is April 30th, 2025.

If a customer is unable to update the registered SIM card name for a valid reason, they can contact their bank to request an exemption. Exceptions may be granted for the following groups:

- Mobile numbers registered under government agencies or organizations.

- Customers with specific needs or legal restrictions, preventing them from changing their mobile number.

- Family members sharing the same number.

- Legal entities that provide numbers to employees.

- Legal guardians of individuals declared legally incompetent by a court order.

Q5: If a child (or a family member) uses a mobile phone and mobile banking, but the SIM card is registered under the mother’s (or another family member’s) name, what should be done?

A5: If a clear connection exists between the mobile number owner and the bank account holder using mobile banking, the customer can contact the bank to submit the required documents as specified by the bank. For further details, customers can check with their bank for specific document requirements.

Q6: If the SIM card is registered under a company’s name, what should be done?

A6: If there is a verifiable connection between the mobile banking user and the organization that registered the SIM card, an exemption may be granted. The customers should contact their bank that holds the account and submit the required supporting documents for verification as specified by the bank.

Q7: What documents are required when contacting the bank?

A7: Customers should contact their respective bank directly to inquire about the required documents.

Q8: By when must this be completed? When is the deadline for completing this process?

A8: According to the regulations set by the Anti-Money Laundering Office (AMLO) and the banks, the process must be completed by April 30th, 2025.

Q9: How can I update my SIM card registration name to match the mobile banking account holder’s name?

A9: The current and new SIM card owner can request a name change at True Shop or dtac Shop with their original national ID card to update the registration. For more details, contact True Customer Service at 1242 or dtac Customers Service at 1678.

Q10: If I decide to change the SIM card owner’s name, will my existing promotions or special privileges be lost, or will they continue?

A10: Changing the SIM card owner’s name is treated as a new ownership confirmation and a new contract will begin. This means all existing benefits or privileges will expire, including: Telecommunications service benefits and other privileges such as True Card, TrueYou, or dtac Rewards

Q11: If I received the bank notification but have not taken any action caused the mobile banking service to be suspended, what should I do and whom should I contact?

A11: As Mobile Banking is a bank-provided service, we recommend contacting your bank directly for assistance. You may also check your bank's mobile app for any suspension notifications related to incorrect registration information.

If your Mobile Banking has already been suspended, you can request reactivation by following these steps:

- Transfer the ownership of your mobile number to your name. If you're using a new number, ensure it is registered under your name.

- Contact any convenient bank branch to request reactivation of Mobile Banking. The bank will perform KYC and facial verification.

- Prepare the required documents as outlined in the reference table (see item 5).

- If you wish to request an exemption, contact your bank directly with the required supporting documents.

- 5. Channels for SIM Ownership Transfer & Document required.

Postpaid Prepaid Thai Foreigner Thai Foreigner Channels for SIM Ownership Transfer True/dtac Shop True/dtac Shop True App

True

https://s.true.th/3aCz/i6exnm8k

dtac

https://s.true.th/3aCz/1xdoy55r

Note:

True and dtac customers can update or correct their information at any True Shop or True Partner.True

At True Shop or True Partner

True App For foreigners

dtac

https://s.true.th/3aCz/1xdoy55r

Note :

True and dtac customers can update or correct their information at any True Shop or True Partner.Documents Required for Updating Information at True/dtac Shops Original ID cards of both the current owner and the new owner. Original ID cards of both the current owner and the new owner. 1. Original ID Card

2. Physical SIM Card1. Original Passport

2. Physical SIM CardDocuments Required for Verification at the Bank 1. Original ID card.

2. Mobile service payment receipt dated within the last 30 days (must be printed on paper; the bank does not accept digital copies). OR

3. “Service Certification Letter” requested directly via the True App, Tab here.1. Original Passport.

2. Mobile service payment receipt dated within the last 30 days (must be printed on paper; the bank does not accept digital copies). OR

3. “Service Certification Letter” requested directly via the True App, Tab here.1. Original ID card.

2. Mobile service payment receipt dated within the last 30 days (must be printed on paper; the bank does not accept digital copies). OR

3. “Service Certification Letter” requested directly via the True App, Tab here.1. Original Passport.

2. Mobile service payment receipt dated within the last 30 days (must be printed on paper; the bank does not accept digital copies). OR

3. “Service Certification Letter” requested directly via the True App, Tab here.Q12: How long does it take to reactivate suspended Mobile Banking service?

A12: The reactivation time depends on the policies of each individual bank.